NANJING APARTMENT

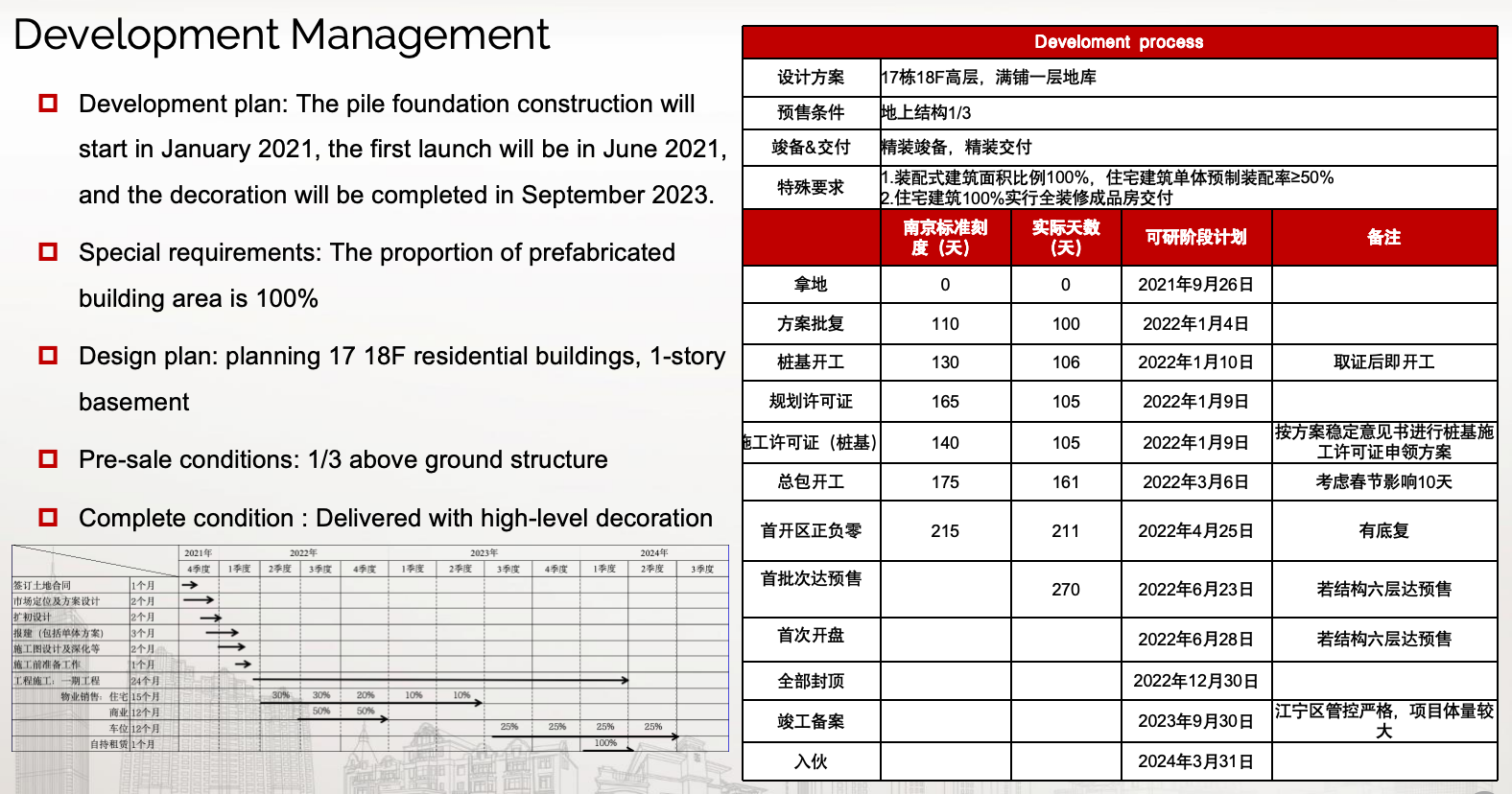

Residential + BUILT TO RENT Development Management

Jiangsu, China

Jun 2021 – Oct 2021

Work As Assistant Development Manager

Selected Individual Work And Workflow Description

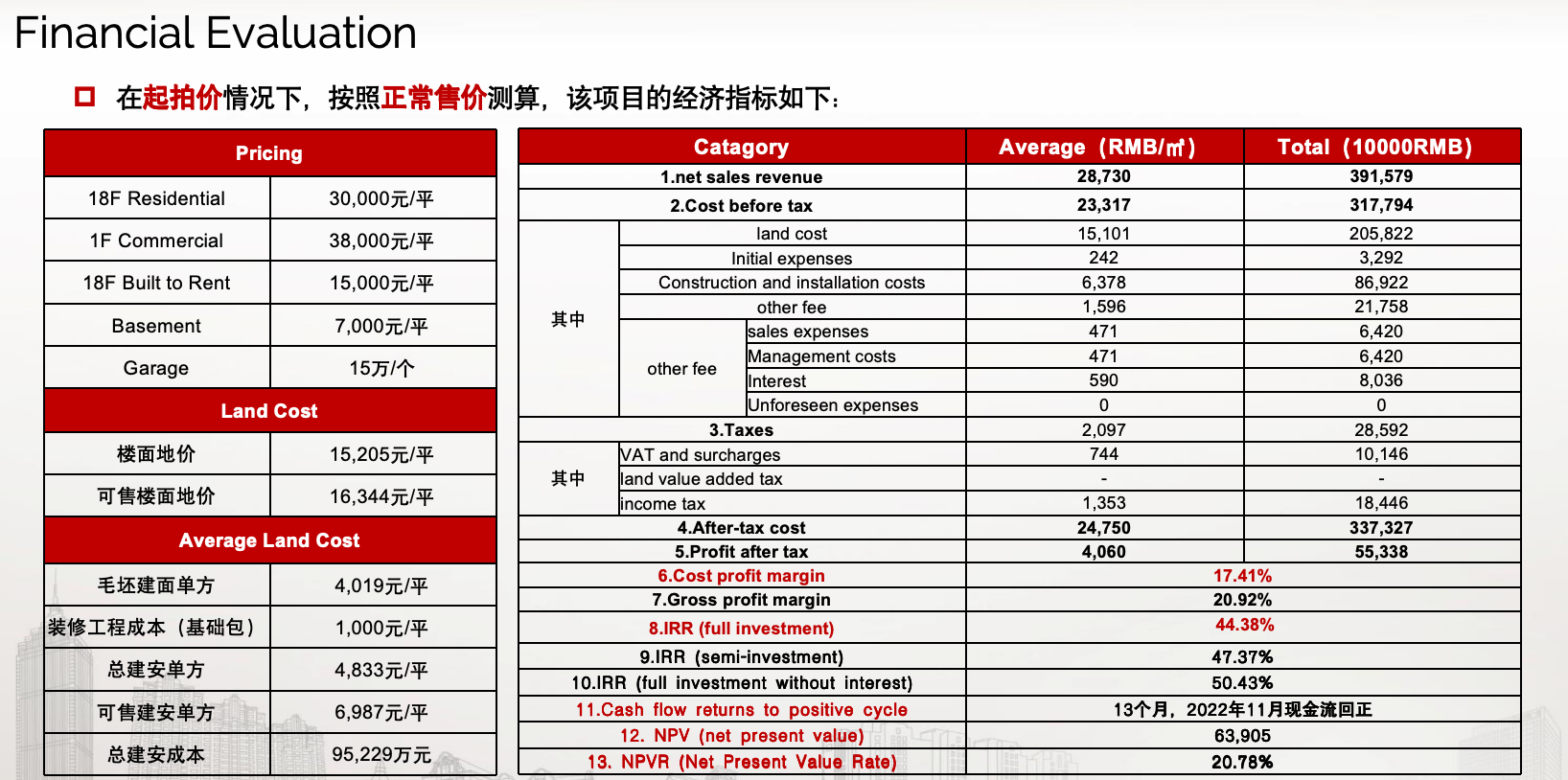

The land was acquired from the auction in October 2021, and the project was estimated to achieve a net profit margin of 17% and an Internal Rate of Return of 44%. After obtaining the sales permit, the apartment was pre-sale in May 2022 and will be completed in May 2024.

· Project Development: China overseas land & investment ltd

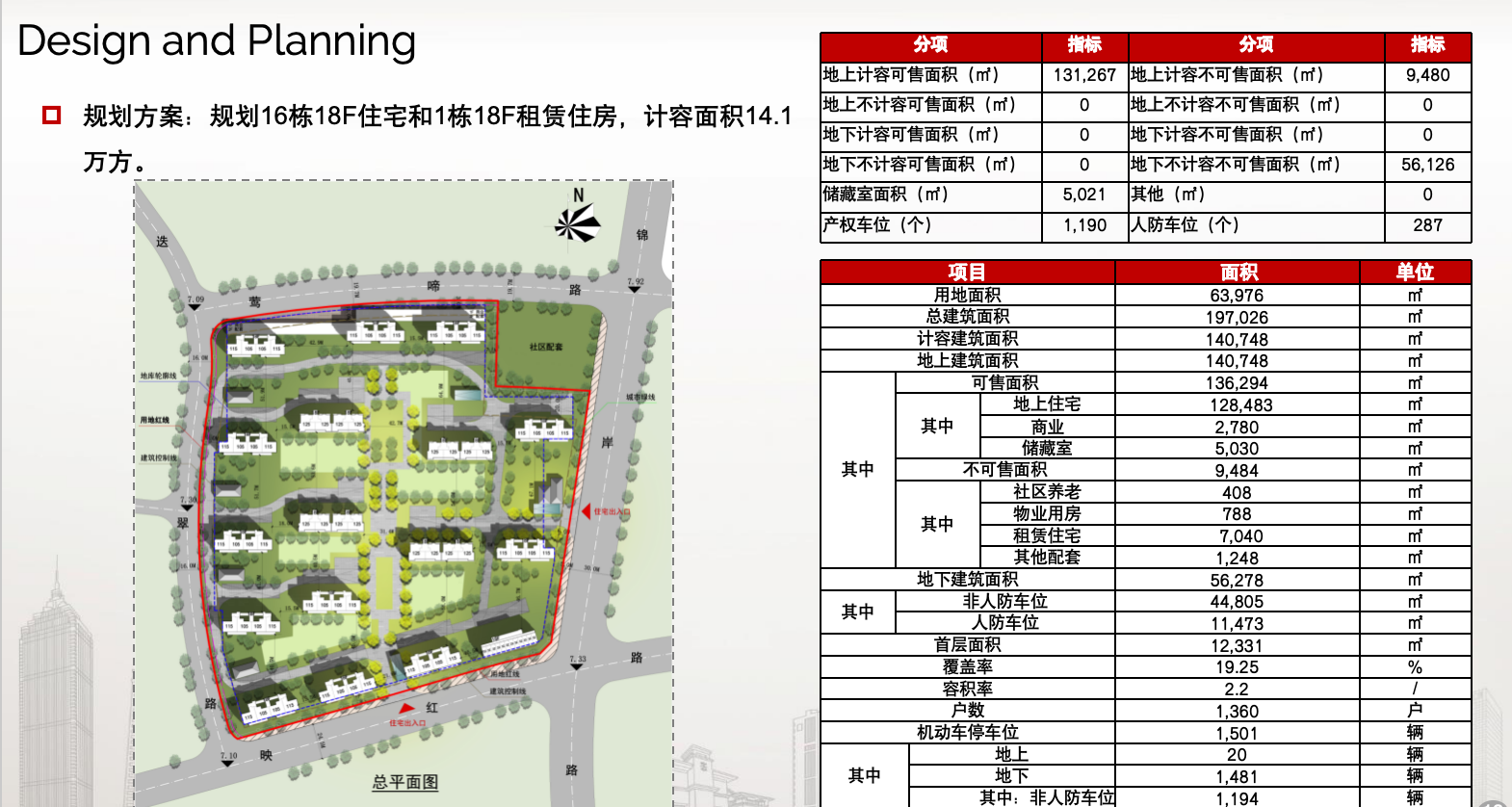

· Land area: 52798.66 ㎡

· Building area: 131267㎡ (Built to rent: 9484㎡)

· Plot ratio: 2.2

· Land purchase price: RMB 2.27 billion

· Unit area: 89/110/130 ㎡

· Community size: 17 buildings (1172 units in total)

· Apartment height: 18 floors

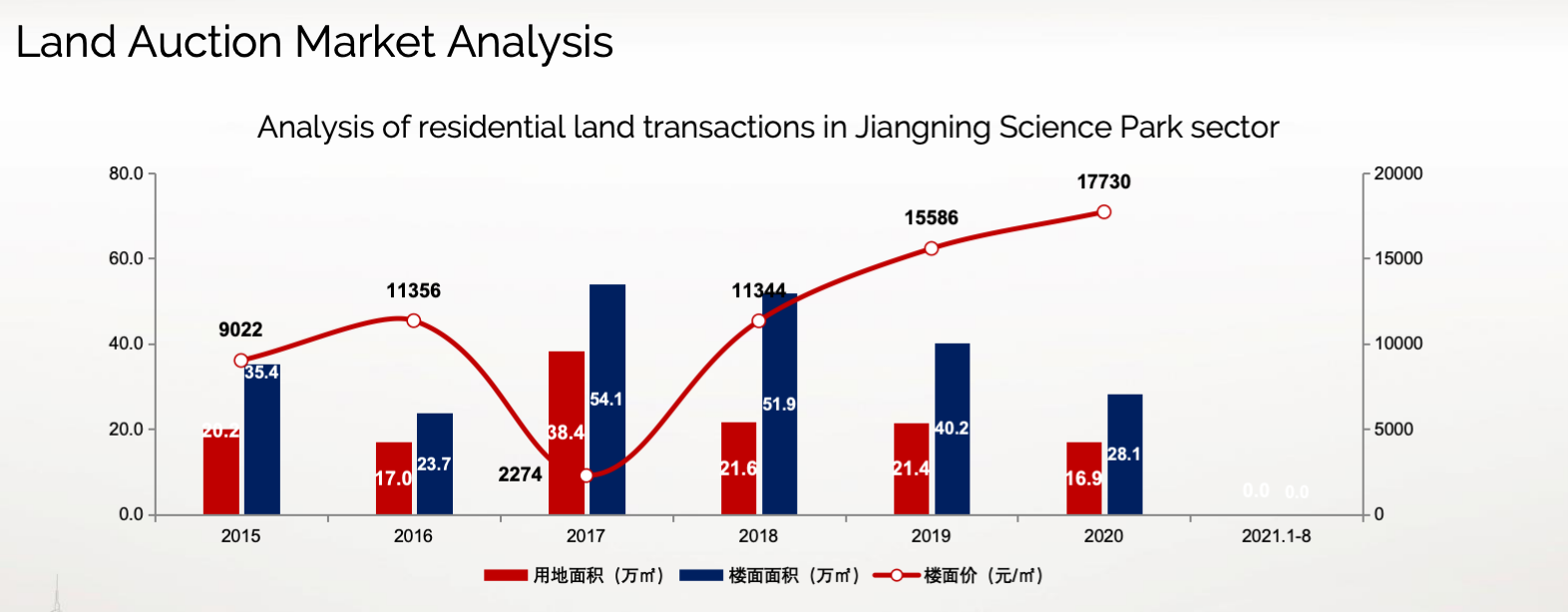

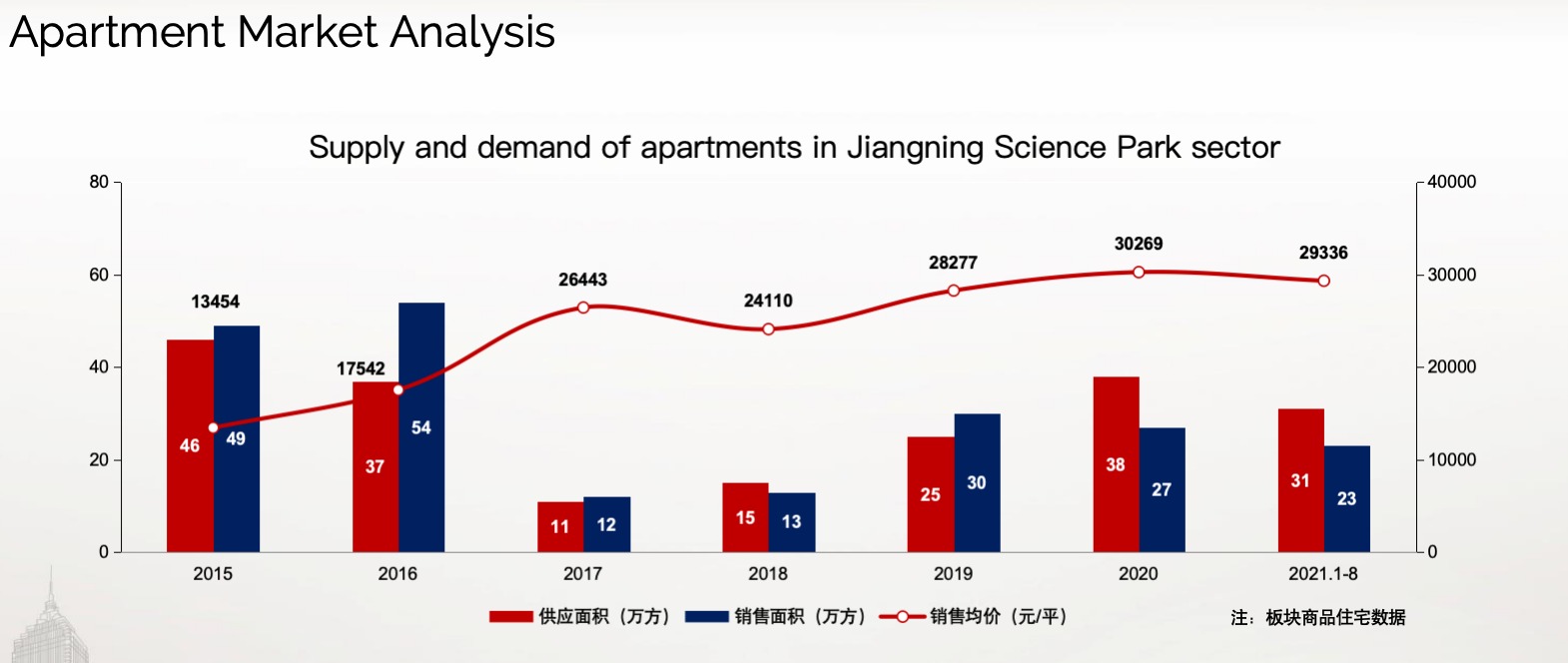

Macroeconomic and Real Estate Market Conditions

Regional economic conditions in Jiangning District, Nanjing, have been buoyant, driven by a conducive environment for innovation and entrepreneurship. The moderate supply of land in the Science Park section indicates a balanced market, while steady demand for apartments and stable pricing underscore the resilience of the real estate market. Company sales and land reserves have remained consistent over the past three years, reflecting sustained investor confidence.

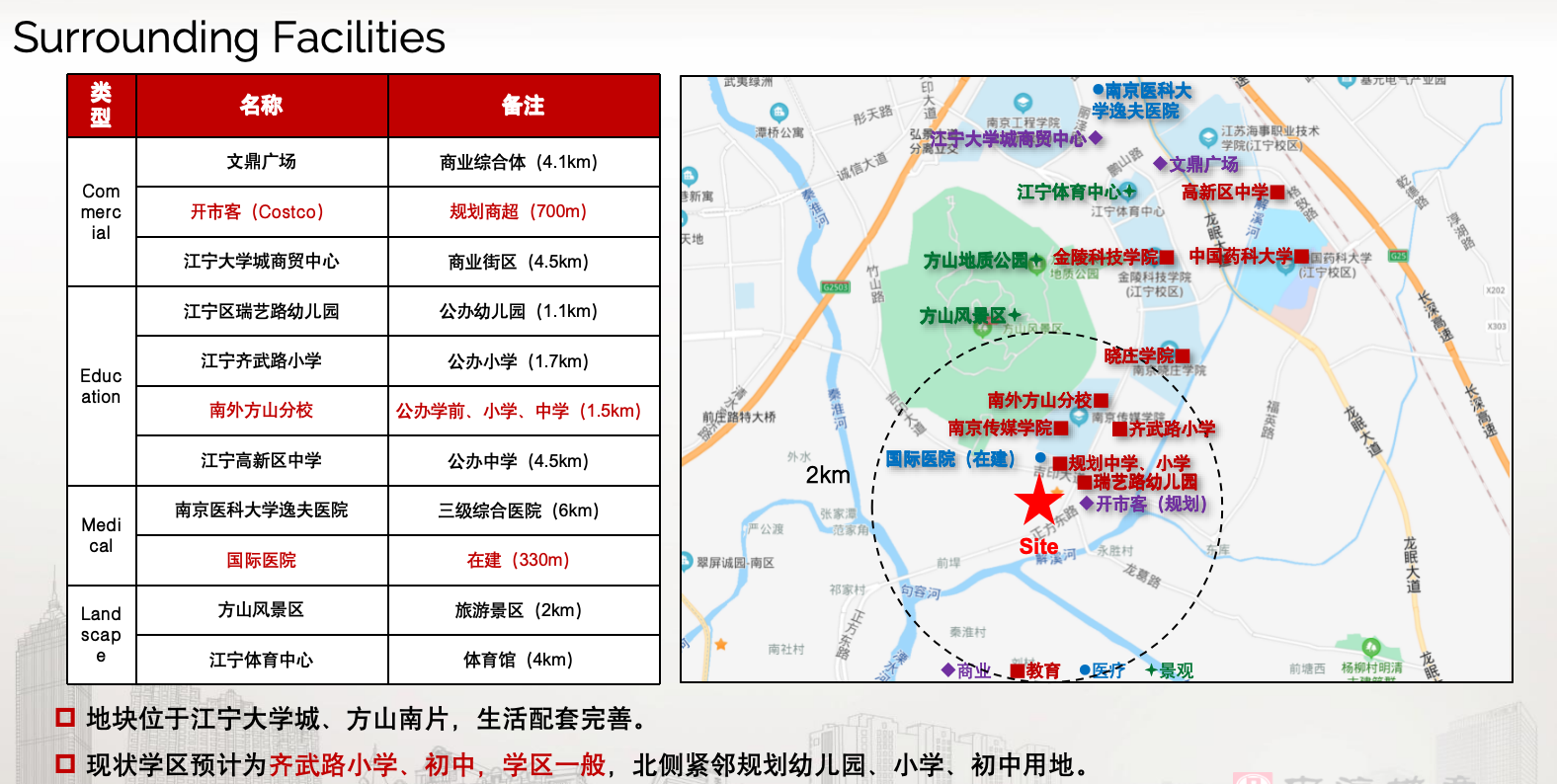

Market Analysis in the Site Area

In the Science Park section (site area), favorable market conditions prevail, with growing demand for residential properties and ample availability of parking spaces and commercial amenities. Commercial sales prices are competitive, signaling a healthy market environment conducive to property development. Comparative analysis of comparable apartment properties in the vicinity highlights the competitive advantage of the proposed development in terms of location and amenities.

Project Development Planning

While the project benefits from its superior location and proximity to industry and educational institutions, potential challenges such as regulatory constraints and competition necessitate careful planning. The project aims to position itself as a high-end residential development offering modern amenities and a vibrant community environment. Emphasis will be placed on quality craftsmanship, sustainable design, and lifestyle offerings to differentiate the development in the market.

Financial Evaluation

Comprehensive financial modeling will be conducted to project the anticipated net sales revenue, pre-tax costs, taxes, after-tax costs, and profits. Cost profit margins and gross profit margins will be analyzed to gauge the project’s profitability, while the internal rate of return (IRR) will provide insights into its financial performance relative to its risk profile. Evaluating the cash flow return cycle will determine the timeline for recouping investment capital and generating positive cash flows from the project.